In an era defined by unprecedented technological advancements, how are payment systems evolving to meet the demands of a rapidly changing world? The answer lies in understanding the dynamic interplay of innovation, security, and consumer behavior, all of which are reshaping the financial landscape, and digital payments are not just the futurethey are the present.

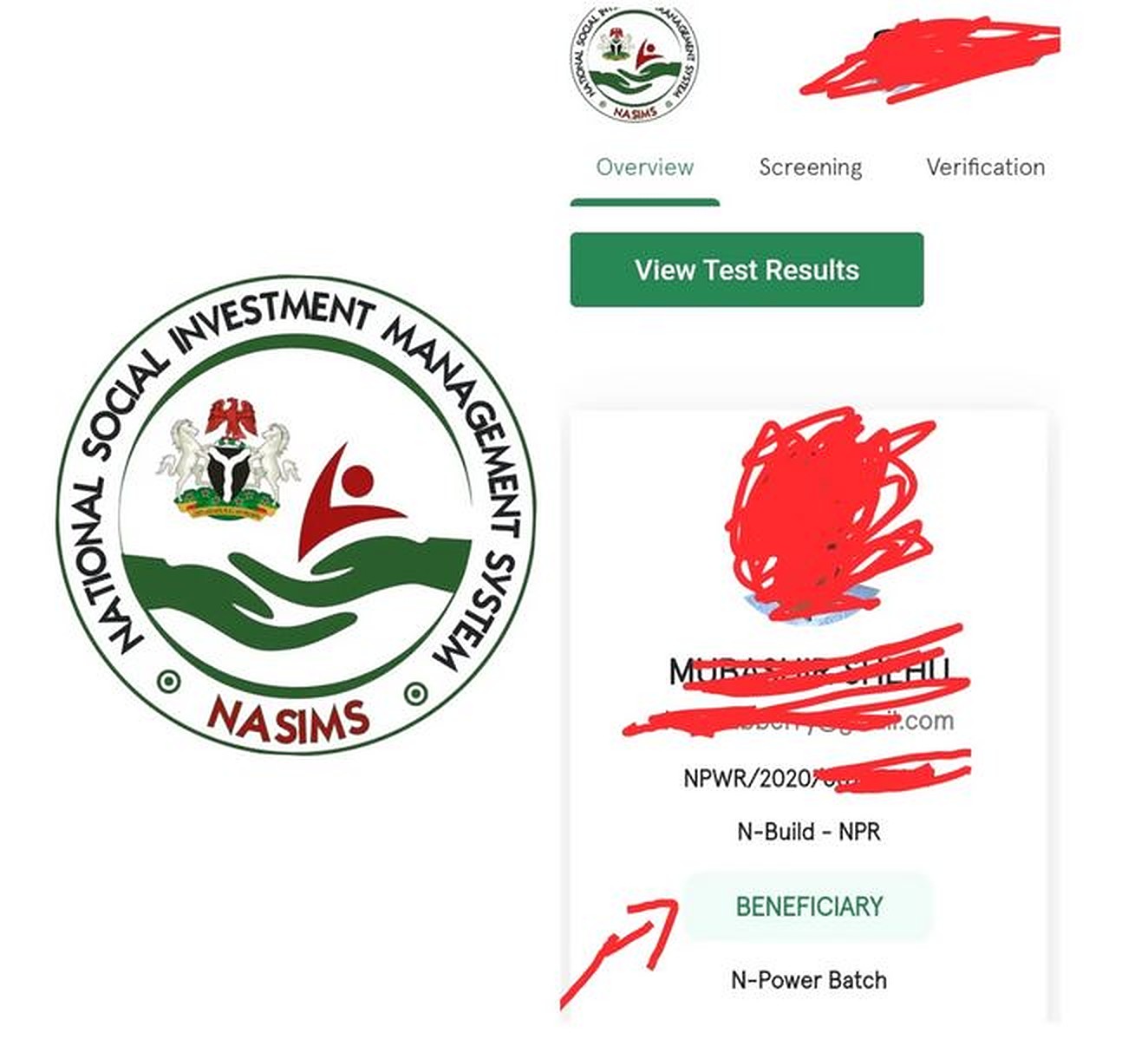

As the global economy continues its relentless march toward digitalization, the very fabric of how we exchange value is being rewoven. Payment systems, once anchored in the tangible realm of cash and checks, are now evolving into sophisticated ecosystems that prioritize convenience, security, and efficiency. Nasims News on Payment Today is committed to providing a comprehensive view of this transformation. From the tried-and-true methods to the bleeding edge of technologies like blockchain and cryptocurrency, we aim to bring clarity to the complexities of the payment world.

Through this exploration, the goal is to offer a thorough examination of the current trends, challenges, and the boundless opportunities that characterize the payment industry. This will allow for a better understanding of how these developments affect financial decisions, as well as business operations.

- Marry Me Pasta A Delicious Dive Into The Global Pasta Sensation

- Rj Barrett Allegations What You Need To Know The Fallout

| Category | Details |

|---|---|

| Name | Nasims News on Payment Today |

| Focus | Comprehensive updates and expert analysis on payment systems |

| Mission | To provide actionable insights and expert commentary on the evolving payment landscape. |

| Target Audience | Businesses of all sizes, fintech enthusiasts, and individuals interested in financial technology |

| Core Topics | Digital payments, blockchain technology, cryptocurrency, security challenges, regulatory impacts, emerging technologies |

| Key Value Proposition | Staying ahead of the curve by delivering timely and relevant information |

| Reference Website | Nasims News on Payment Today |

The very nature of the payment industry is in constant flux, propelled by technological leaps and evolving consumer preferences. This evolution touches every aspect, from the smallest brick-and-mortar store to the largest multinational corporations, all of which are impacted. Nasims News on Payment Today provides key insights into this sector.

One of the most noticeable trends is the ubiquity of mobile payments. Smartphones are rapidly becoming the preferred method for transactions, with apps like Apple Pay and Google Wallet leading the charge. The second is biometric authentication. Security is paramount, and technologies like fingerprint scanning and facial recognition are increasingly becoming standard in payment systems. Another noteworthy trend is the rise of Peer-to-Peer (P2P) payments. Platforms such as Venmo and PayPal are transforming how individuals send and receive money, making it instant and efficient.

These changes are fundamentally altering the way businesses and consumers interact with payment systems, yielding increased convenience and improved security, a pivotal shift in the digital age. The evolution of payment systems is not just a technological upgrade; it is a transformation of the entire financial experience.

The widespread adoption of digital payments has cemented their role as a cornerstone of modern commerce. A report from Statista projects that the global digital payment market will reach an impressive $6.7 trillion by 2023, a testament to its growth. This surge can be attributed to a number of key factors.

Firstly, the proliferation of the internet has provided more people than ever before with the ability to access online platforms, in turn, making them key participants in the shift to digital transactions. Secondly, the user experience of digital payment platforms has evolved, becoming increasingly intuitive and user-friendly, guaranteeing a smoother, more seamless experience for consumers. Lastly, digital payments often offer lower transaction costs compared to traditional methods, offering a cost-effective solution that businesses are increasingly drawn to. This is a shift that requires a thoughtful adjustment to meet the needs of a tech-savvy consumer base.

Yet, the benefits of digital payments also bring about significant security challenges. Cybercriminals are continuously finding new ways to exploit weaknesses within payment systems. Data breaches pose a major risk, exposing sensitive financial information. Phishing attacks, where fraudsters use deceptive tactics to extract credentials, are also on the rise. Additionally, malware can infect devices and steal payment data without the user's knowledge.

To counter these threats, payment providers are heavily investing in enhanced security measures. These strategies include multi-factor authentication and encryption technologies, which are essential to safeguarding consumer information. This proactive approach reflects an understanding of the constant need to stay ahead of evolving cyber threats.

Regulation plays a crucial role in shaping the landscape of the payment industry. Governments and financial authorities worldwide are implementing stricter rules to ensure the safety and integrity of payment systems. Key regulatory developments are:

- PSD2 (Payment Services Directive 2): This European regulation aims to enhance consumer protection and promote competition within the payment market.

- GDPR (General Data Protection Regulation): Data privacy laws such as GDPR compel payment providers to adopt more transparent practices in handling customer data.

- Anti-Money Laundering (AML) Regulations: Financial institutions must adhere to AML laws to combat illicit activities, including money laundering and the financing of terrorism.

These regulations are designed to create payment systems that are not only secure but also transparent and accountable, which builds trust and fosters confidence in the digital financial infrastructure.

Understanding Blockchain

Blockchain technology has the potential to revolutionize the payment industry by providing a decentralized, transparent, and secure method of conducting transactions. Unlike traditional payment systems, blockchain eliminates the need for intermediaries, reducing costs and increasing efficiency.

Benefits of Blockchain in Payments

Some of the key advantages of using blockchain in payment systems include:

- Real-Time Transactions: Blockchain enables instant settlement of payments, eliminating the delays associated with traditional banking processes.

- Lower Fees: By removing intermediaries, blockchain reduces transaction costs for businesses and consumers.

- Enhanced Security: The decentralized nature of blockchain makes it highly resistant to cyberattacks and fraud.

As blockchain technology continues to mature, its adoption in the payment industry is expected to grow significantly. The core value proposition of blockchain in payments is the promise of security, transparency, and speed, an attractive combination in the modern financial world.

Cryptocurrencies like Bitcoin and Ethereum have emerged as viable alternatives to traditional payment methods, further diversifying the industry. They offer several benefits.

- Global Accessibility: Cryptocurrencies are borderless and can be used anywhere in the world, which overcomes the limitations of local currencies.

- Decentralization: Cryptocurrencies operate outside the control of central banks, giving users more control over their finances.

- Transparency: All transactions on the blockchain are recorded publicly, ensuring accountability and building trust.

The volatility of cryptocurrencies and the persistent regulatory uncertainties represent hurdles to their widespread adoption. However, their potential to transform payment systems is undeniable.

Consumer behavior is adapting quickly in response to technological advancements and societal changes. Today's consumers are better informed and more demanding, expecting seamless and secure payment experiences. Key trends in consumer behavior include:

- Preference for Contactless Payments: The increased preference for contactless payments is driven by health concerns and the demand for convenience.

- Increased Use of Mobile Devices: Smartphones are now the primary tool for making purchases, both online and in-store.

- Focus on Security: Consumers are increasingly prioritizing security when selecting payment methods, favoring platforms that offer robust fraud protection.

Businesses that adapt to these shifting consumer preferences will be better positioned to thrive. This requires understanding the customer's priorities and adjusting to the new normal of mobile and contactless transactions.

The future of payment systems is being shaped by the development of emerging technologies. These technologies hold the promise of a more efficient, secure, and consumer-friendly payment environment.

- Artificial Intelligence (AI): AI can enhance payment systems by improving fraud detection, personalizing user experiences, and optimizing transaction processing.

- Quantum Computing: This cutting-edge technology has the potential to revolutionize encryption and security in payment systems.

- Internet of Things (IoT): IoT devices are enabling new payment methods, such as smart refrigerators that can automatically reorder groceries.

The maturation of these technologies has the potential to create new opportunities for both businesses and consumers, which drives further innovation.

- Breast Changes Understanding Embracing Your Bodys Journey

- Taylor Swifts Dance A Deep Dive Into Her Iconic Performances