Is it possible for a state to directly share its wealth with its citizens, creating a financial safety net and fostering a sense of collective ownership? The Alaska Permanent Fund Dividend (PFD) proves that it is possible, and it has reshaped the economic and social landscape of the state since 1982.

For those residing in or considering a move to Alaska, understanding the intricacies of the PFD is not just beneficialit's essential. The program provides valuable insights into how the state manages its vast resources, particularly its oil wealth, and equitably distributes it among its population. This article explores the history, operational mechanics, advantages, and obstacles associated with the PFD, offering a comprehensive guide to this unique and impactful program. It aims to provide a deep dive into how the PFD works, its impact on the Alaskan economy and society, and what the future may hold.

Whether you're a current Alaskan resident, a prospective newcomer contemplating a move, or simply a curious observer interested in innovative approaches to wealth distribution, this guide will equip you with the necessary information. Lets delve into the story of the PFD, its role in Alaska's economic structure, and what it means for the people who call the state home.

- Post Malone Nashville Music City Influence Career Impact

- Rdr2 Controls Optimize Your Gameplay Experience Customization Guide

Here's what we'll cover:

- The Historical Background of the Alaska Permanent Fund Dividend

- PFD Eligibility Requirements

- Applying for the PFD: A Step-by-Step Guide

- Calculating the PFD Amount: The Financial Formula

- The Economic Influence of the PFD

- Social Gains Achieved Through the PFD

- Challenges Facing the PFD in the Present Day

- The Projected Future of the PFD

- Answers to Common Questions About the PFD

The Historical Background of the Alaska Permanent Fund Dividend

The genesis of the Alaska Permanent Fund Dividend can be traced back to 1980, when Governor Jay Hammond signed the legislation that established the Alaska Permanent Fund Corporation. This was a landmark decision with the goal of ensuring that future generations of Alaskans would reap the benefits of the states vast oil reserves. The establishment of the fund itself was a forward-thinking measure, and it used a portion of the states oil revenues. These revenues are channeled into a diverse portfolio of investments designed for long-term growth and returns.

The year 1982 marked the inaugural distribution of PFD checks to qualified residents, thereby initiating an annual tradition. Over the years, the PFD program has grown significantly, with payments varying from a few hundred dollars to more than two thousand dollars per person, depending on the funds performance and decisions made by the legislature.

- Unveiling Arab Girls Culture Achievements Future Learn Now

- Sabrina Carpenter From Disney Star To Global Icon

This innovative approach to wealth distribution, which began in Alaska, provided the financial foundation for the program's success, as well as fostering a unique sense of communal responsibility and financial planning among the residents of Alaska. Through careful management and consistent growth, the PFD has become an integral part of the Alaskan economy, supporting the financial security of the people who call Alaska home.

Key Milestones in the PFD's History

- 1976: The Alaska Permanent Fund is established.

- 1980: The PFD program is created.

- 1982: First PFD checks are issued.

- 2008: The largest PFD payout to date, with each resident receiving $2,069.

PFD Eligibility Requirements

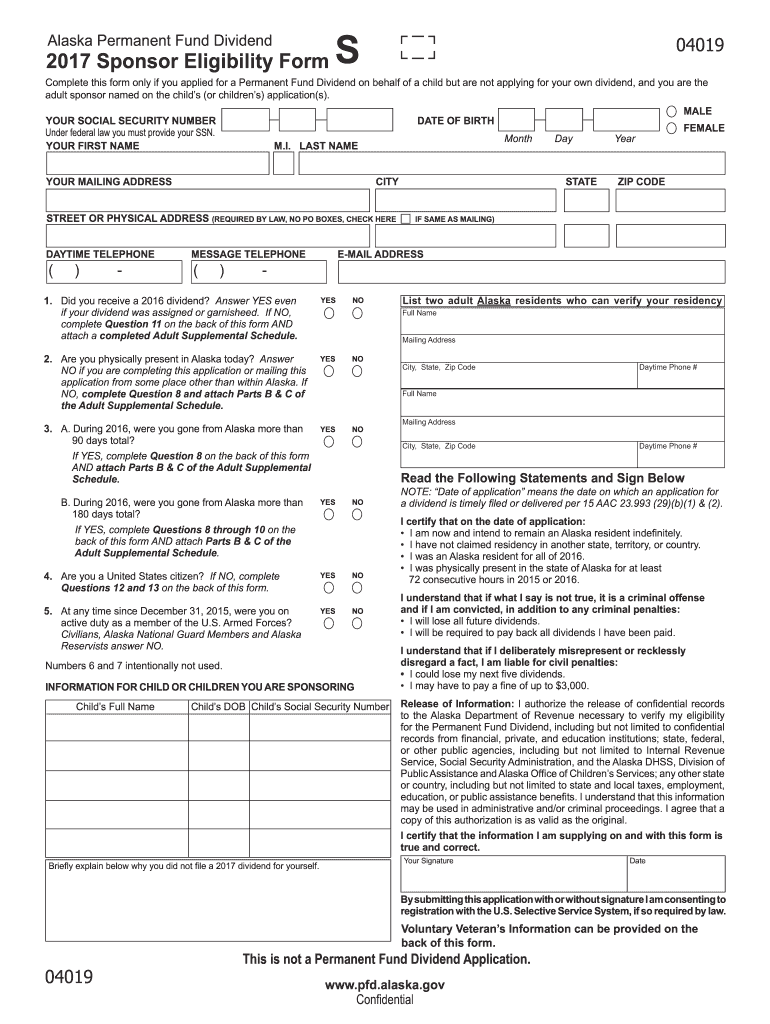

To be considered for the Alaska Permanent Fund Dividend, applicants must meet specific criteria established to ensure that only bona fide residents of Alaska receive this benefit. These requirements are critical to maintaining the integrity and sustainability of the PFD program, as well as ensuring the distribution of funds to qualified individuals. The primary conditions include maintaining residency in Alaska for a full calendar year, demonstrating a clear intention to remain a resident indefinitely, and limiting absences from the state to no more than 180 days within the eligibility period.

In addition to these general requirements, there are certain legal exclusions. Individuals who are incarcerated or residing in a medical facility outside of Alaska, for example, are not eligible. The Alaska Permanent Fund Corporation conducts thorough reviews of all applications to verify that applicants meet the residency and eligibility requirements, which helps to protect the program and prevent fraud. The goal of the process is to ensure that the PFD remains a reliable and equitable program for all eligible residents of Alaska.

Residency Requirements

- Must have lived in Alaska for the entire year.

- Must intend to remain a resident of Alaska indefinitely.

- Cannot claim residency in another state or country.

Applying for the PFD

The process of applying for the Alaska Permanent Fund Dividend has been designed to be straightforward. Residents can apply online through the official Alaska Permanent Fund Corporation website, which is the most efficient and recommended method. The application period typically begins in January and closes in March of each year, providing a specific timeframe for residents to submit their information.

Applicants are required to provide personal information, documentation to prove their residency, and financial disclosures as part of the application process. For individuals who prefer to apply using a paper form, those forms are available upon request. However, the online application is highly encouraged due to its convenience and the faster processing times it offers. This ensures that the application is handled quickly, efficiently, and with minimal chance of errors or delays. Ensuring that all the required documentation is accurate, complete, and up-to-date is critical to avoid any potential delays or disqualifications.

The online application process ensures that the information is submitted accurately and efficiently. The state of Alaska provides resources and support to help applicants through the process and ensures fairness and accuracy in the distribution of the dividend.

Calculating the PFD Amount

The amount of the Alaska Permanent Fund Dividend fluctuates annually, depending on both the fund's investment earnings and the decisions made by the state legislature. The formula used to compute the dividend is based on a straightforward approach. It involves calculating the average earnings of the fund over the prior five years and dividing that amount by the total number of eligible residents. This approach guarantees that the payout amount is closely linked to the financial health and sustainability of the fund.

In recent years, the PFD payouts have ranged from approximately $1,000 to $2,000 per person. Several factors influence the final amount, including oil prices, overall market performance, and budgetary considerations by the state. By understanding this calculation process, residents can better anticipate their potential dividend amounts. The Alaska Permanent Fund's structure is transparent and the calculation ensures the distribution of funds remains sustainable.

Factors Affecting PFD Payouts

- Oil prices and production levels.

- Investment returns of the Permanent Fund.

- State fiscal policies and legislative decisions.

The Economic Influence of the PFD

The economic impact of the Alaska Permanent Fund Dividend is undeniably substantial. The program pours millions of dollars into the local economy on an annual basis, which, in turn, stimulates consumer spending and supports small businesses. Studies have shown that the PFD significantly contributes to Alaska's GDP, with many residents using the funds to cover essential expenses, to save, and to invest in various opportunities.

Furthermore, the PFD acts as a stabilizing force during economic downturns, offering residents a degree of financial security and assisting in the reduction of poverty rates. Its widespread distribution ensures that the benefits of the PFD are felt across a wide range of socioeconomic groups, thereby encouraging a sense of economic equality across the state. This impact extends beyond individual finances, helping to create a more resilient and prosperous economy overall.

Statistics on Economic Benefits

- Approximately $2 billion distributed annually to residents.

- Boosts local spending by an estimated 10-15% during payout months.

- Reduces poverty rates by providing a reliable source of income.

Social Gains Achieved Through the PFD

Beyond its significant economic advantages, the Alaska Permanent Fund Dividend also offers a multitude of social benefits. It encourages financial literacy among residents and promotes responsible financial management. Many Alaskans use their dividend to invest in education, start their own businesses, or save for the future. This enhances their long-term financial health and overall well-being. It also serves as a key driver for a more secure and empowered community.

The PFD also fosters a sense of community and shared ownership of Alaska's natural resources. It serves as a tangible reminder of the state's commitment to its residents and the importance of equitable wealth distribution. The social benefits are integral to a higher quality of life for Alaskans, including a sense of belonging, shared responsibility, and financial empowerment that goes beyond individual prosperity. These aspects contribute to a strengthened social fabric.

Examples of Social Impact

- Increased access to higher education through savings and investments.

- Empowerment of women and minority groups through financial independence.

- Enhanced community engagement and civic participation.

Challenges Facing the PFD in the Present Day

While the Alaska Permanent Fund Dividend offers a multitude of benefits, it also faces several challenges that could potentially threaten its long-term sustainability. The volatility of oil prices, influenced by global market conditions, can directly impact the fund's earnings, potentially reducing future payouts. Additionally, ongoing legislative debates regarding budget allocations and fund management can create uncertainty for residents. The challenges require careful consideration and forward-thinking solutions to maintain its long-term viability.

To address these challenges, strategic decision-making is essential. Diversifying the fund's investments and exploring alternative revenue streams are ongoing efforts. Moreover, ensuring the funds sustainability while maintaining its core mission of benefiting Alaskans is crucial. This balancing act is vital for the continued success of the PFD, as well as the well-being of the state's citizens.

The Projected Future of the PFD

Looking ahead, the future of the Alaska Permanent Fund Dividend continues to look promising. There are ongoing efforts to strengthen the funds financial health and adapt to the ever-changing economic environment. Innovations in investment strategies and policy reforms are being implemented to guarantee the programs sustainability for generations to come. These changes help to ensure the program's longevity and continued success.

As Alaska continues to evolve, the PFD is expected to play a pivotal role in shaping the states economic and social landscape. Its consistent commitment to equitable wealth distribution and resident welfare underscores its relevance and importance for the years to come. Through forward-thinking strategies and proactive measures, the PFD is positioned to continue benefiting Alaskans.

Answers to Common Questions About the PFD

1. How often is the PFD distributed?

The PFD is distributed annually, typically in October.

2. Can non-residents receive the PFD?

No, only eligible Alaska residents can receive the PFD.

3. What happens if I miss the application deadline?

If you miss the deadline, you will not receive the PFD for that year. It's essential to apply within the specified timeframe.

- Boo Did I Scare You Job Application Guide Get Hired

- Lena The Plug Jason Luv New Video Breaks The Internet